Dethroning the Dollar

Step One

I hope you are having a great week!

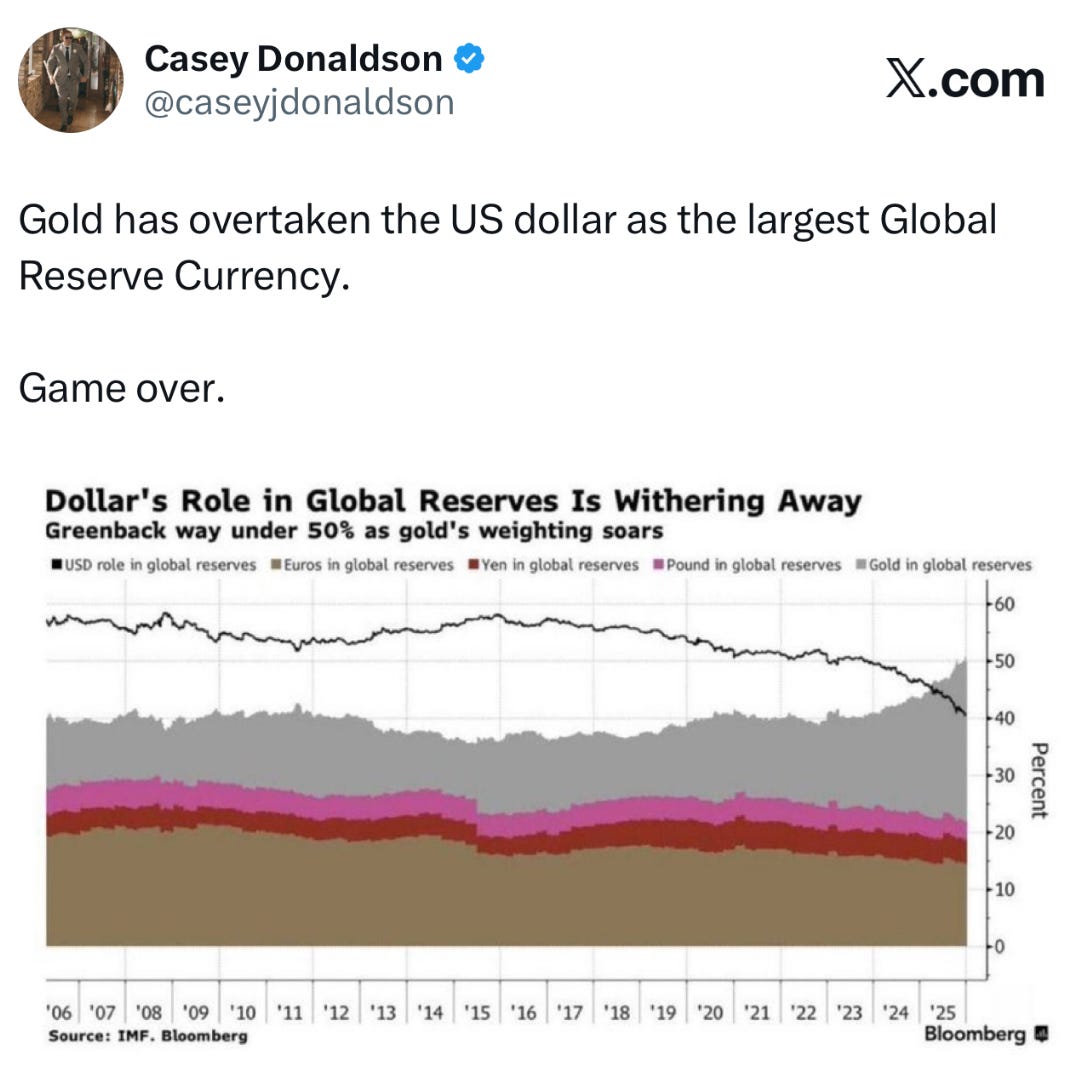

To kick off 2026, gold has officially overtaken U.S. Treasuries as the largest foreign reserve asset held by central banks.

This is a historical shift in asset management by global reserve banks, driven by uncertainty created by U.S. administrations over the last 20 years.

Since the early 2000s, global reserve managers have watched periods of financial stress, geopolitical conflict, rising U.S. debt levels, and increasing political polarization, all of which have increased the need for diversification.

Inconsistent U.S. policy has led the globe to drift away from relying on America.

Over the last several decades, administrations of both parties have shifted sharply between globalization and protectionism, intervention and restraint, and tight and loose monetary policy. For foreign governments tasked with maintaining long‑term economic stability, this volatility has made diversification required.

Central banks have increased gold holdings by $4 trillion, surpassing U.S. Treasuries.

Gold accumulation accelerated after the 2008 financial crisis, again during the 2010–2012 European debt crisis, and once more during the global uncertainty created by the COVID‑19 pandemic. Several emerging‑market central banks, including those in China, Russia, Turkey, India, and various Middle Eastern nations have been steadily reducing their Treasury exposure for more than a decade

Events that have diminished trust in just the last 25 years:

9/11: Did Osama bin Laden fly planes into the Twin Towers, or was there an agenda to get troops in the Middle East for oil?

2008 Great Financial Crisis: Fraud and relaxed lending standards almost brought down the whole system.

COVID‑19: We shut down the economy and pushed vaccines that were not fully studied over a virus that killed 0.001% of people.

Would you trust a country that printed its own currency to defend these mistakes?

The dollar is still the primary currency to settle global trade transactions, but replacing Treasury reserves with gold is step one to dethroning the dollar.

Historically, gold has been the ultimate neutral reserve asset. Not tied to any nation, political system, or debt cycle, which is why countries concerned about geopolitical fragmentation have returned to it.

And replacing the dollar in global trade is in the works, as China came out last week with Xi Jinping calling for the Chinese yuan to be a global reserve asset.

The US dollar hegemony faces a real threat.

Thanks for being apart of this.

Casey Donaldson