Breaking Up with Buffett

September 2025

When Warren Buffett speaks, the world listens. But he has earned that credit. Warren Buffett could lose 99 percent of his fortune and still have outperformed the S&P 500 over his career. Who else can say that? The quote below is from Buffett as he announced his retirement at the Berkshire Hathaway annual meeting, and it’s now playing out in real time:

We still have very substantial inflation in the United States but it’s never been runaway, yet. And that’s not something we want to try and experiment with because it feeds on itself. So I wouldn’t want the job of trying to correct what’s going on in revenue and expenditures of the United States with roughly a 7% gap when probably a 3% gap is sustainable. And then the further away you get from that, the more you get to where the uncontrollable begins… It’s a job I don’t want, but it’s a job I think should be done and Congress does not seem good at doing it.

Inflation, government spending, and stock valuations all have one common theme: all they do is move higher. This is why Buffett, the best investor of all time, has been a net seller of stocks for three years and has a cash position that has ballooned to record highs of $350 billion.

Warren Buffett's legacy is being the best stock picker of all time, but underneath that elite microeconomic mind is a crafty capital allocator that allows the macroeconomic theme to guide his decisions. Buffett shut down his investment partnership in 1969 due to outrageous stock market valuations. Only looking at single businesses would have never led him to that outcome.

Buffett, the eternal optimist, even hinting at a debt crisis, runaway inflation, and uncontrollable debt growth is a sign of concern, and you should take notice. Always buying into the market when there is blood on the streets is not for the faint of heart, but Buffett has made a career out of it for eight decades, always believing things will get better. But is the optimism dwindling?

Buffett's claim of not wanting the job of fixing the spending problem of the American government is a subtle way of telling people this problem may not be fixable. Don’t forget, it was Warren Buffett on the phone with Secretary of the Treasury Hank Paulson during the Great Financial Crisis of 2008, guiding him on how to navigate the crisis. A 76-year-old Buffett was willing to rise to the challenge a hell of a lot more than a 95-year-old Buffett.

The forever believer in American exceptionalism is no longer buying bonds and has instead been focused on the energy sector. The macroeconomic conditions of today eerily resemble the 1970s. High inflation + long-term dollar devaluation + reindustrialization of the West is the perfect structural backdrop for commodity stocks.

Berkshire is too big to buy gold, but not so big to take a few large bets on some energy plays. Occidental Petroleum and Chevron have been among the few consistent investments we’ve watched Buffett make over the last few years. The oil play has not quite worked out how the crafty legend had hoped, but it could still be the early innings of this sticky inflation situation.

Can you imagine if Berkshire Hathaway were to buy gold? What a logistical nightmare. At current gold prices, if Berkshire deployed $100 billion of the $350 billion cash pile into gold, that’s 885 metric tons of gold bars. Almost as much as China imported in 2024. Buffett would need a private military, literally, to move this gold to a vault somewhere he felt comfortable.

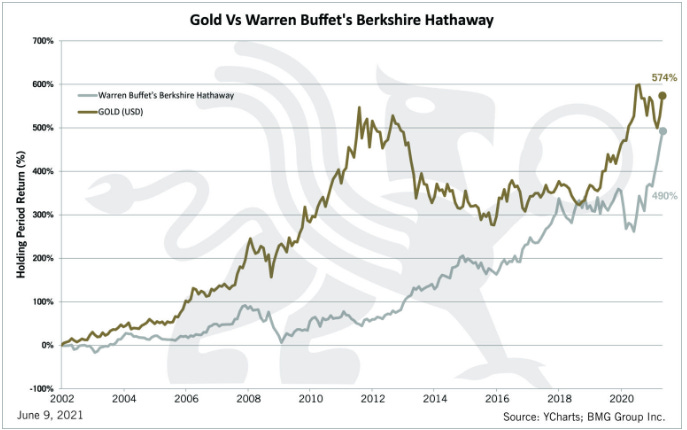

So, it's a good thing Buffett has always believed gold was a dumb investment. According to him, it’s just a rock that doesn't produce any cash flows; therefore, it's not worth the investment. But who is going to tell the investing legend that gold has tied or maybe even slightly outpaced an investment in Berkshire Hathaway? The world is changing, and Buffett knows it.

I would never diminish the record or brilliant mind of the best investor of all time, but the world is changing. The AI bubble, gold, and crypto are not something Buffett can wrap his mind around. The AI bubble is so big, AI investment has overtaken consumer spending in the American economy. Gold has turned into an anti-USD bet by the BRICS nations, and Congress passed a bill allowing stablecoins to be backed by U.S. Treasuries. The microeconomic world is being overtaken by the new world economy, making it the most difficult it’s ever been for old-school value investors.

When I first began my investment journey, I was a hardcore Warren Buffett disciple. I mean, he was the best to ever do it, so why not? I evaluated individual businesses, waiting for my pitch to go big when it was just how I liked it. I avoided gold because Buffett told me it didn’t produce anything. I avoided Bitcoin because Charlie Munger, the VP of Berkshire Hathaway, said it was worthless rat poison.

I was passionate about macroeconomics deep down, but Buffett always told me to avoid it, and I obeyed. Reading annual reports from businesses was fine, but I never loved it. I didn’t do my own work or follow what I loved more. Gut feelings exist for a reason, so you should listen to them. Buying gold and Bitcoin when I wanted to years ago would have changed my financial life, but I didn’t because I listened to the greatest investor of all time.

You don’t often hear people go against Buffett. I understand why he didn’t do it, but I would encourage everyone to learn from my mistake and follow your own journey, no matter who tells you not to do something, as long as you feel good about your decisions, pull the trigger.

He will always hold a special place in my heart, but as of now, Warren Buffett and I are breaking up.

https://thefelderreport.com/2025/05/09/warren-buffetts-misunderstood-macro-bet/

One of the most surprising things college taught me is that professors are elite-level salespeople. I just didn’t realize I was the one being sold to. I never took a general level class without a professor giving multiple reasons for how much money can be made in their field. It all makes sense now. Without continuous enrollment in these majors, the college has no reason to keep them around. It feels like professors take advantage of kids who do not yet understand the world.

Computer science used to be one of the highest-paying fields right out of college. If you could code, you were damn near guaranteed a six-figure salary, but things have changed. This title from the New York Times sums up the new trend in the field of computer science: “Goodbye $165,000 tech jobs. Student coders seek work at Chipotle.”

It’s not just computer science. Drive by your local strip mall. Insurance brokers, local banks, mortgage brokers, lawyers, accountants, consultants, and real estate agents should all be nervous. AI is coming for you. In just 2-3 years, AI will cause 10-25% less employment in these fields. What about in ten years?

Consultants should be the most frightened. AI can analyze information, crunch data, and deliver a badass PowerPoint deck within seconds. Consulting won’t even exist in a few years.

McKinsey & Company is the largest consulting firm in the U.S. Since 2023, McKinsey has already cut its workforce from 45,0000 to 40,000 and rolled out 12,000 AI agents. It’s only a matter of time before a small human workforce runs tens of thousands of AI agents for most companies.

An IPO prospectus for Goldman Sachs would normally take a six-person team two weeks. Now AI does 95% of the work within five minutes. The last 5% of these projects are now a commodity, and the only part that investment banks can compete on. Wall Street will see the bottom layer of all investment banks shrink.

All these stories are from the last few months. Even more troubling is that the largest sector of recent job growth has been healthcare. We discussed last month that healthcare is the industry most in the crosshairs of AI, especially the administrative side. The second place to be targeted by AI is education. The Biden economy was built on health care and education job growth. Not very comforting.

The undermining of the American economy by AI has begun. AI will hit service-based business first, and conveniently, the U.S. is a service-based economy. Jobs are the lifeblood of an economy, with impacts that you don’t realize until their absence, with some consequences not showing up for years down the road. US tax receipts and spending dollars for consumption will decline, and that is just the starting point.

The second and third-level impacts of AI taking jobs cannot be discounted. The highly educated will begin to lose high-paying jobs. What will happen to the U.S. financial system when high earners begin to go delinquent on mortgage loans, student loans, and consumer loans? We will be left with two choices: print the money or accept the deep recession.

Displaced white collar workers will turn bitter as inequality hits levels we have never seen before. Are you ready to see socialist mayor candidates like Mamdani in power across the country? The displaced workers will not have the power to bring their careers back, but they do have the power to vote for someone who will level the playing field, even if that candidate is part of an extreme political party.

AI will change the world more like the railroads did, as opposed to other technologies. It’s an infrastructural change in the world. You should not be asking yourself how you can invest in AI. You should be asking yourself how the companies you are investing in will leverage AI to create a type of company the world hasn’t seen before. The railroad companies weren’t the best stocks to invest in; it was the companies that used the railroads to build the best businesses.

AI is incompatible with a debt-based monetary system, so even if AI is half as successful as I am predicting, it will be the end of the debt-based monetary system.

Are you invested accordingly?

https://fftt-treerings.com/tree-rings/fftt-tree-rings-august-15-2025/

This podcast blew my mind. The Chinese are running a true masterclass in manufacturing.

People who have lived in China have firsthand accounts of the advancements the country has made across all sectors. Cameron Johnson comes right out of the gate in this interview, claiming Trump is living in a fantasy land if he thinks he can isolate China. China has spent 20 years investing in the region to avoid being isolated. It will take more than four years for a U.S. administration to change that.

From China’s perspective, it’s hard to follow what is going on in the Trump administration. Applying tariffs, removing tariffs, increasing them to this product, and then reducing them on the same product a week later. Supply chains take 15-20 years to establish, and the erratic behavior is only slowing down the process that Trump claims he wants to revive.

As Americans, do we want to bring back manufacturing? We need to bring back some manufacturing due to the national security threat of producing nothing. But the most recent jobs report came out on Friday, and the average work week is 35 hours. You’re going to tell me people will sign up to work 6 days a week, 12-hour shifts to bring manufacturing back to the U.S.? Not a chance. The average American doesn’t give a shit about toys being made in the U.S.

As soon as Trump got elected, the Chinese started making moves. The high-end products with high margins remained in China, while the lower-end products were relocated to Vietnam. China was ready to play defense.

Aside from a good defense, the way China’s supply chain ecosystem is structured it’s unlike anything the world has ever seen. The focus on the infrastructure – electricity, massive AI integration, 5G, raw materials, the processing of raw materials, etc., allows them to be ready for any industry with any number of SKUs. China focuses on the parts and pieces, and being the very best at that, they are not as concerned with the whole truck.

You can’t just have the best system. You also need people to work in the system. This is where China’s workforce of 220 million in manufacturing stands out. To put this in perspective, the entire workforce population in the U.S. is 170 million. It’s impossible to compete with this scale of workers.

Now that the Chinese structure is in place, the process has begun of looking outward. The Chinese first policy of the last 20 years has been a major success, and now the process of beginning new ventures has begun. If you give the Chinese royalties, they will gladly invest and help you set up shop in your own country. The Chinese think it’s odd that Trump wants everything within the borders of the U.S. when they don’t even want that for China. It’s also easier for China to say that when you are the manufacturer of the world.

Looking ahead to the future, China is way ahead on AI, and it’s not even close. DeepSeek is the one company we’ve heard a lot about, but they have ten companies just as competitive, working their asses off for their own breakout moment. It’s only a matter of time.

China has more students going into engineering and quantum computing per year than the entire EU and America combined. Chinese kids start AI courses as young as six years old. The U.S. isn’t competing with that. We are struggling to even keep our electric grid up in a hot summer, let alone prepare for an AI build-out on a giant scale.

Tariffs should be looked at as a balloon. We may be able to squeeze some products out of China, but that air needs somewhere to go. Just because it leaves China doesn’t mean it won’t just end up in another part of Southeast Asia. If it’s still cheaper to be made there, it will be. What makes sense will win.

The question I want to leave you with is: after China has invested decades and hundreds of billions of dollars to build out EV supply chains, why does America want to spend the time and money to do the same? China is willing to do it for us for a few billion.

Investments