The Daddy of 'Em All

August 2025

It’s not called the Daddy of ‘Em All for no reason. Cheyenne Frontier Days (CFD) is the world’s largest outdoor rodeo, held every year at the end of July. For most, winning is a dream, but it’s still just another stop during Cowboy Christmas, the nickname for the summer run of rodeos in early July. This is where I found myself two weekends ago.

CFD began in 1897 as a one-day rodeo designed to boost the town's economy and preserve Western culture. Events included pony races, bronc riding, and steer roping, among others. Today, it’s ten days long, attracting over 300,000 visitors to the Wyoming capital to test the skills of cowboys and cowgirls and ultimately pay out over 1 million dollars in prize money.

After the rodeo events, Cheyenne also holds concerts with big-name artists every night of the week. Luke Bryan, Brooks & Dunn, and Cody Johnson were on this year's lineup. I was fortunate enough to make it to the Cody Johnson and Randy Houser concert on Friday night at the rodeo.

The history of the American cowboy is deeply intertwined with vaquero traditions, originating in Mexico. Spanish settlers brought cattle and horses to the Americas, and the indigenous Mexican cowboys, known as vaqueros, developed the skills of horsemanship, roping, and cattle handling that became the foundation of the American cowboy. Ranching and cattle herding practices spread from Mexico into what is now the Southwest United States, including Texas, Arizona, and New Mexico.

Cowboy culture today is alive and well. Thanks to shows like Yellowstone, it’s never been more popular to wear a cowboy hat, even if you’ve never set foot on a ranch. Of course, the show glamorizes the lifestyle and makes it appear to be enjoying the mountains and having fun. In reality, ranch life is far from that. Everyone wants to be a cowboy until it’s time to do cowboy shit. Fixing fences, being covered in cow shit, and making minimum wage is what you can expect working on a ranch.

It would be a big mistake to think ranching life and rodeo life are the same thing. Rodeoing is a sport, while ranching is a career, although many rodeo cowboys come from ranch backgrounds, and many rodeo checks have been invested back into the family business. While the purses for rodeos have never been, doing what is required to make it to the top is no easy task.

Everyone dreams of being the next million-dollar cowboy, but do you have what it takes? Driving thousands of miles per year to enter another chute just in the nick of time to make your living is not for the faint of heart. At Frontier Days, some of the riders will ride early in the week, head to Salt Lake for another ride (a quick 7-hour drive), and then come back to Cheyenne to try and catch another check, and maybe even win the championship buckle.

If you aren’t winning, you aren’t making any money. Sponsorships get most guys down the road, which also don’t come without success, and a little bit of a savvy business mindset. At first, it’s not uncommon to see four guys sleeping in a truck, but if you can hang on and place consistently, it’s possible to turn it into a career. Bradlee Miller is the #1 bareback bronc rider in the world right now. He’s raked in $151,573 for the year so far, and he isn’t even close to done.

While I have fallen off a horse and stepped foot on a few ranches now, I am just another poser in cowboy boots compared to the people living it for generations. Observing lifestyles completely different from our own on our travels gives us insight, knowledge, and appreciation of life’s journey.

If there is one thing cowboys don’t need to worry about, it’s AI replacing them.

It’s never happened in capitalism that one of the largest companies on the planet (Meta) that had increased its market cap by $1.5 trillion over the prior three years would fire 5% of their workforce. – Jordi Visser

When productivity growth drives profits and stock prices higher, it has always resulted in that company hiring more people. More people = more profits in an efficient model. For the first time in history, AI is driving lower employment with higher productivity.

And this is not just at Meta. You may have heard of these companies seeing similar results:

Microsoft

Ford

JP Morgan

Amazon

Bank of New York Mellon

Anthropic

What industry is at the top of the list to be disrupted by AI? Let me introduce you to the United States healthcare industry: an industry where cost rises faster than inflation most years and healthcare is consuming more and more of the American citizens' budget while receiving worse outcomes. AI can do small things for huge reductions in spending.

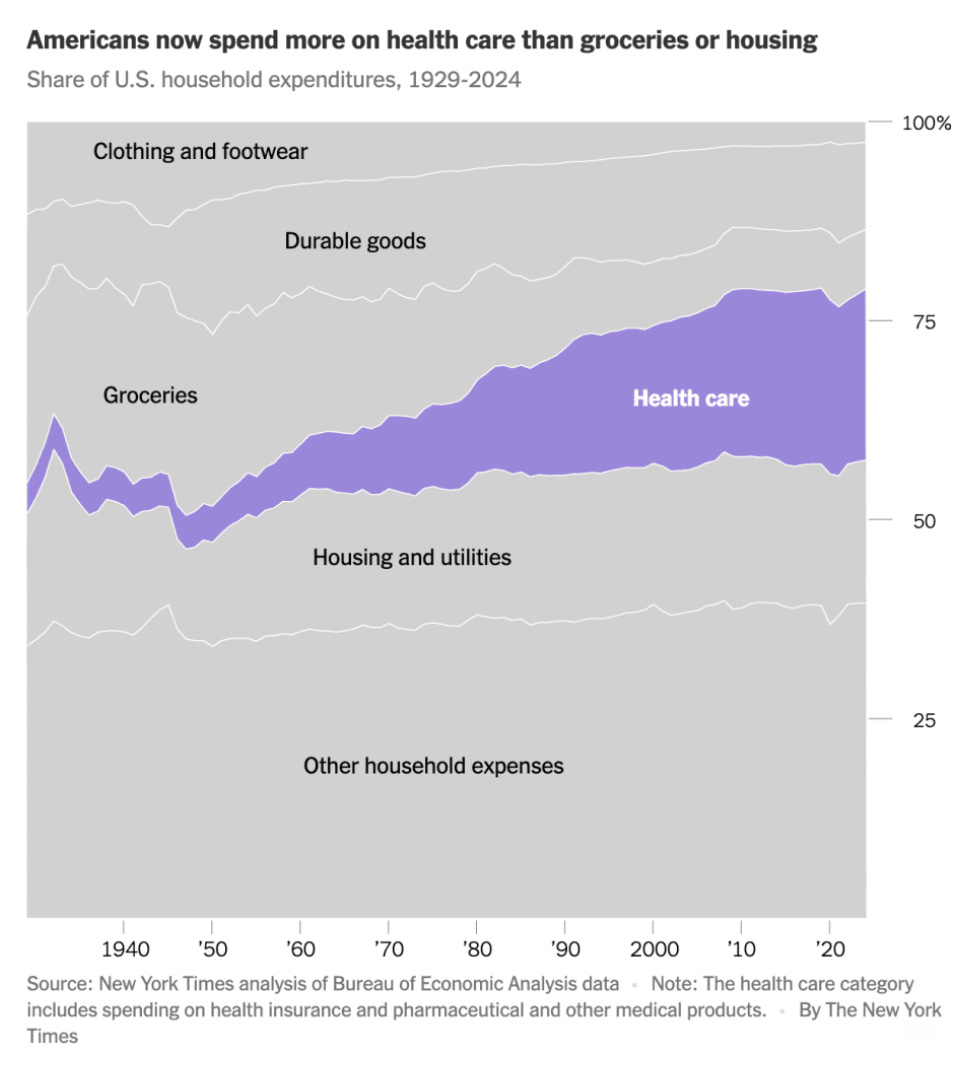

We are beginning to see people spend more on healthcare than food and shelter, while Americans are less healthy than they have ever been. Today, health care is taking up 18% of consumer spending, while in 1982 it was only taking up 12%, with a life expectancy of only five years lower, and 5-10% of spending in the 1960s.

Microsoft AI diagnosed complicated cases with 85% accuracy compared to 20% for its human counterparts, but it’s important to consider that humans were not allowed to access textbooks or confer with colleagues.

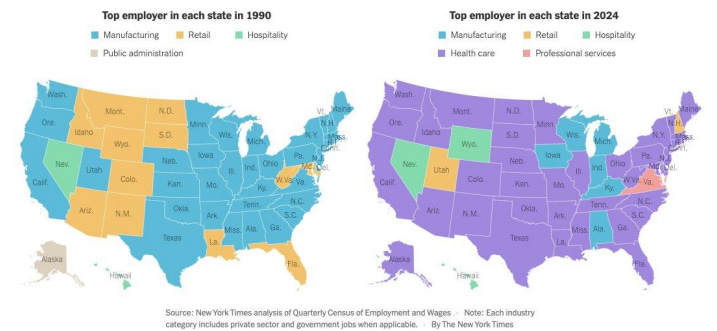

AI replacing humans at a task seems simple, but there are second-level impacts to the economy that don’t appear right away. As early as 1990, the top employers in most states were manufacturing and retail. In 2024, healthcare was the top employer in 38 of 50 states.

Employment in the largest industry in 38 of 50 states doesn’t just fall apart without feeling some major impacts. These aren’t minimum wage jobs. These are high-paying health care jobs that recycle spending back into these states’ economies. Health care jobs going away will result in defaults on housing and consumer loans, similar to the way American manufacturing workers did after their jobs were shipped to China.

States will witness the double-edged sword of the hit to healthcare and housing, resulting in the need to figure out a way to absorb the losses. As tax receipts take a hit along with increased recession fears, states will be begging for AI adoption in healthcare. Balanced state budgets are a requirement, and Medicaid is one of the largest budget items.

The Trump administration's attempts to reshore jobs and the deportation efforts don’t look so bad considering the job losses to AI in the next 3-5 years. President Trump is looking to turn more states blue in the above graph, while getting rid of illegal immigrants, taking the precious jobs still available.

The takeaway here is that highly indebted Western governments are spending entirely too much on healthcare, while being desperate for spending cuts. AI is about to take a machete to the healthcare sector, consuming 17-18% of spending that could likely be cut in half in the next five years. Governments are not ready for the tax receipts or the employment hit of the largest employer in 38 states. Governments will be forced to either let debt markets fail or print the money to support these markets.

Gradually over time, the incumbents which make up the S&P 500 will be under extreme attack, and I don’t think they’re going to be replaced. The 2030s will be a graveyard for the Fortune 500. AI is forcing China and the U.S. to race faster than ever and deregulate. –Jordi Visser

This means the most profitable companies of the 2030s do not exist yet.

If there is one interview you should listen to this month, it’s this one: World-renowned economist Richard Werner with Tucker Carlson.

Richard Werner watched the boom in Japan of the late 80s and early 90s, which is still playing out in Japan with their insane debt levels. The U.S. has been monitoring this situation closely, as we are looking for some kind of playbook to follow with our own ballooning debt levels. In 1989, Japanese land prices were so outrageous the Imperial Palace Garden (which is a public park) was worth all of the real estate in the state of California. Yes, one park is worth more than all the real estate in LA, San Francisco, San Diego, Sacramento, Fresno, and Oakland combined.

Something is wrong in macroeconomics. Part of the problem is that we have not had any progress in macroeconomics in over 100 years. We are currently running experiments with credit creation, deficits, and money printing the world has never seen. And the main culprit in the middle of it is the banks.

One cute little detail economists leave out is that banks do not exist in economic theory. Economists call banks intermediaries in the economy, but in reality, all banks do is create credit or, to put it another way, banks make loans, creating money out of thin air. The more financing and lending in an industry, the more those asset prices get inflated. This is most apparent in housing today. Huge loans (money created) to purchase an asset drives prices higher, and if prices are to ever drop, there is a crisis.

Banks creating credit for consumption purposes lie at the heart of inflation. When the money supply is increased, but no goods or services are created, that money is raising the price of that asset artificially. Real growth is created when credit is used for business investment. Inflation occurs when too much money is chasing after too few goods or services. Sound familiar?

In macroeconomics, the biggest development of the last 100 years is the expansion of central banks. While very controversial for a reason, central banks are private institutions supporting the credit creation of smaller banks across the country. Central banks are there to support the banks, but not so much the individual.

In the U.S., we have a love/hate relationship with our Federal Reserve Bank. And again, for good reason. The Central Bank and income taxes were created on the same day. December 23rd, 1913. This was the perfect day to make sure most of Congress was not in Washington, D.C., but back home in their districts, enjoying the holidays with family. You don’t do this for a bill that has support.

The Federal Reserve was sold on the premonition that it would be the lender of last resort after a few roller coaster boom/bust cycles in the U.S. The first test was the Great Depression. As people rushed the banks to pull out their deposits, banks were failing left and right. The Federal Reserve did step in as the lender of last resort for some banks, but that did little to help the individual who just watched their savings account vanish like a speck of dust in the wind during the Dust Bowl. People were even more thrilled as family savings vanished, but the debt for the purchase of the farm was kept. The lucky ones were allowed to work on the farm as laborers on the farm they lost. Not exactly the way to get public support.

Central banking goes deeper than that in society. Central banks are the largest controllers of behavior. When the central bank controls credit allocation, it controls the level of freedom of the individual. The lower the number of institutions issuing credit, the lower the level of freedom that exists. Free countries like the US issue credit via hundreds of banks in every state, allowing citizens to open businesses to provide for a family. Whereas in the Soviet Union, they had one bank issuing credit with a board reviewing credit applications, making sure the money could be paid back. If you don’t have a healthy flow of entrepreneurs opening businesses and creating jobs, there is no way for people to support a family other than by relying on the state. Open credit creation = freedom.

When the system starts to fail people, we begin to see uprisings like we are seeing today. People want to attack China for stealing economic growth, but the only way to change the system is to change the way you view the system. Economic growth is not a win/lose system. One country does not gain at the loss of another. We need to begin to look at economics through a physics lens. In physics, there is no growth. Nothing is ever created or destroyed. So where did the term economic growth come from? Economic growth was a term created by economists and statisticians as a measure of the ability to service the national debt.

Richard Werner will give you a whole new view of the world of banking and credit creation. Just watch the damn interview.

Lifestyle

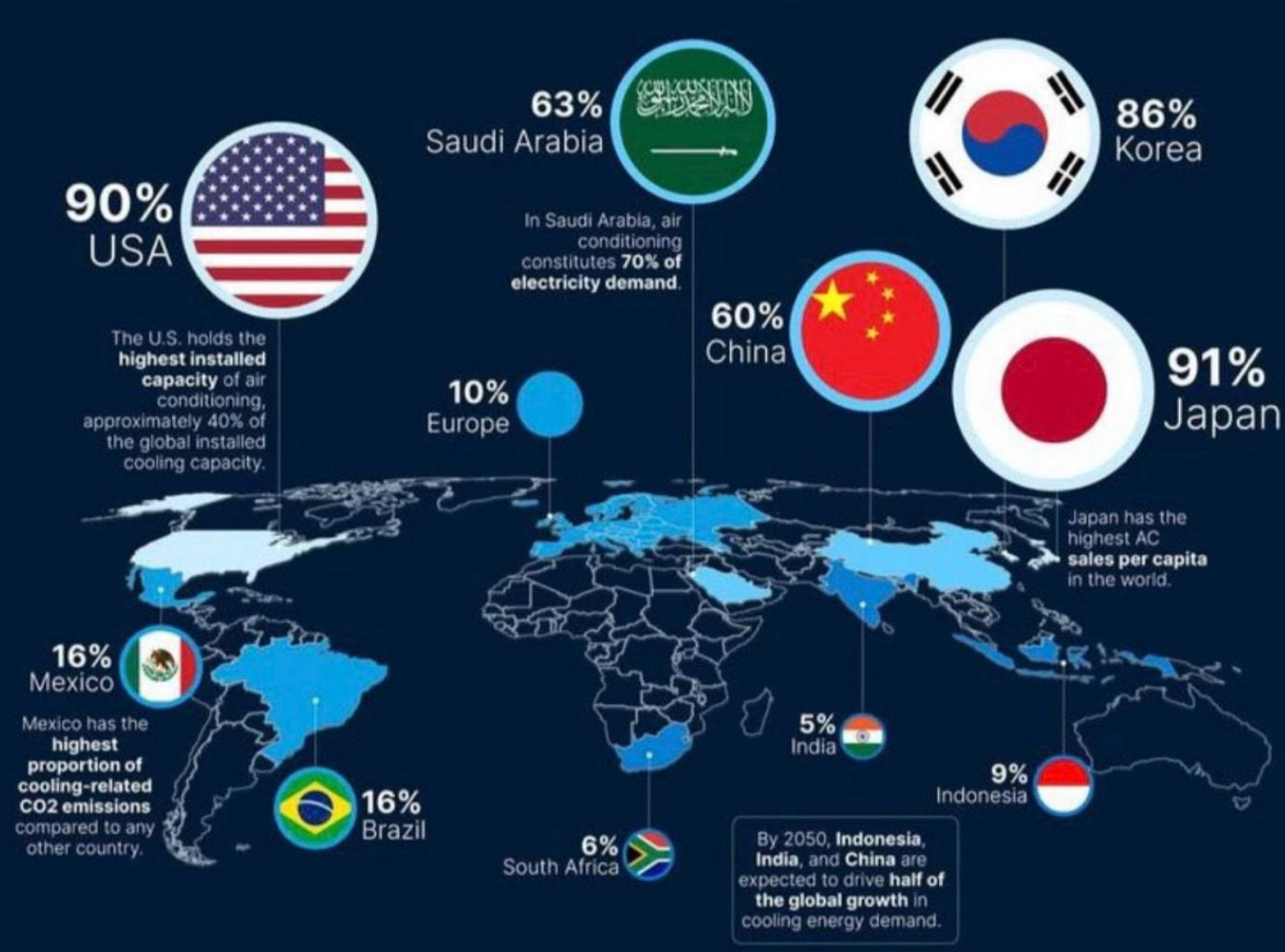

I finally installed the air conditioning in my house. Talk about a game changer. Whether you believe in global warming or not, it seems places that didn’t use to need AC now do. Developing countries need energy to build infrastructure ,while developed countries need energy for the expansion of air conditioning.

Air conditioning uses huge amounts of energy. You can count on your AC unit to use up to 20% of your household energy in the summertime. This is also what accounts for the rolling blackouts in the dog days of summer. People want comfort in developed nations, and you don’t get that without air conditioning.

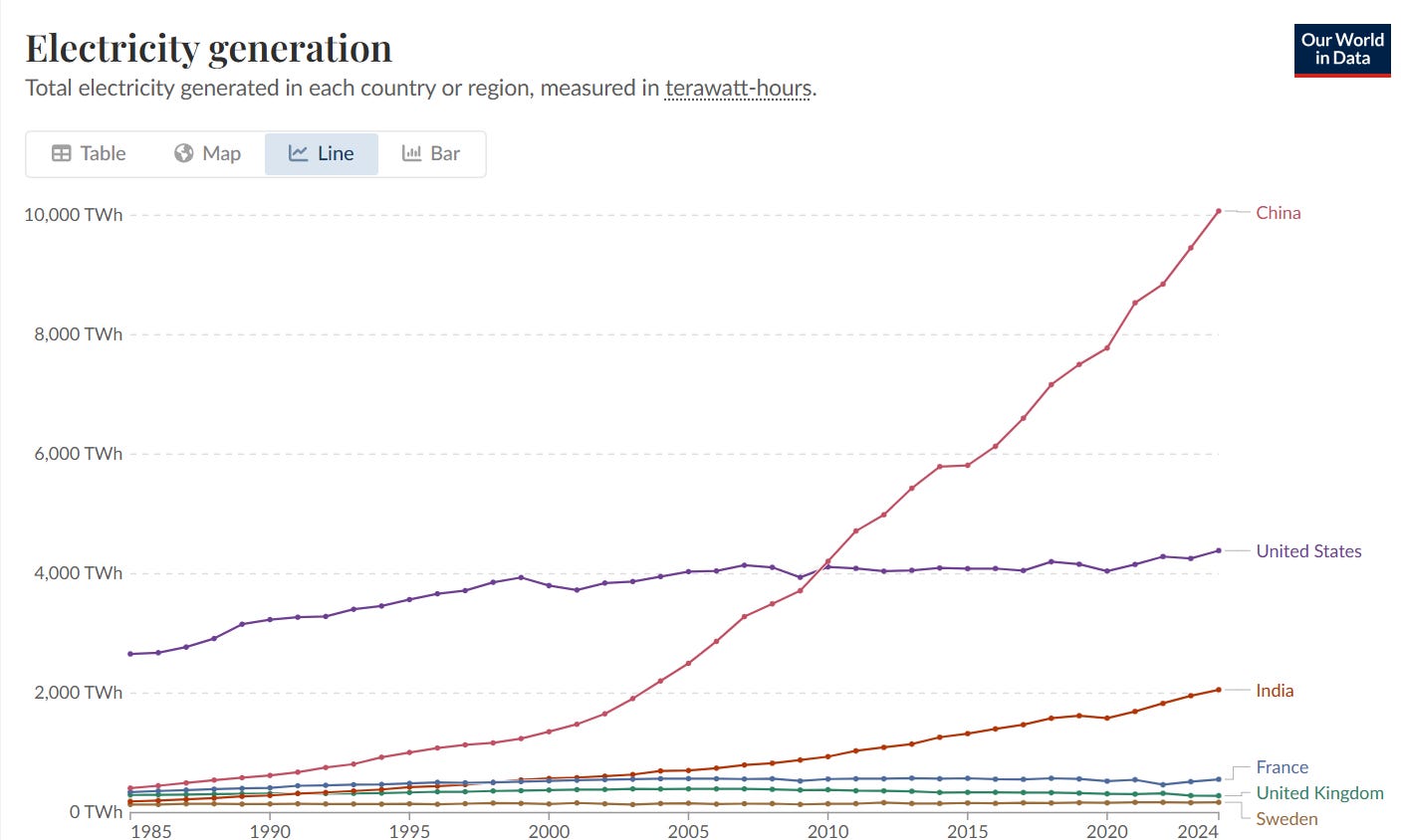

The world needs more energy, caused in part by air conditioning, world development, and the huge surge in demand for artificial intelligence. China understands this need and is leading the world in electricity generation.

China has watched the U.S. and the EU destroy their economies over global warming while doubling energy generation, building entire electrical cities, and overhauling manufacturing with AI. While Trump is limiting certain forms of energy, China is unleashing production on all fronts.

China continues to expand all forms of energy: wind, solar, oil, and nuclear. The biggest electricity generator for the entire country is still the hero-turned-villain coal. 60% of China’s electricity generation comes from coal. China is laughing at the West as the West severely limits growth and enforces strict regulations due to global warming. The Key Bridge in Baltimore was hit by a cargo ship a year ago, and no repairs have even begun. China would have built 7 new bridges by now, powered by coal.

Once traveling through Casper, Wyoming, in 2022, I met a gentleman named Mike who worked on upgrading coal plants with the new technology. Mike was an ex-Navy SEAL who had floated the Colorado River through the Grand Canyon eight times and slept outside over 120 days the previous year. For most, the Grand Canyon float would be a once-in-a-lifetime trip, but not for him. While Mike acknowledged his career was dying due to green energy initiatives, his defense for the coal industry was always the saying, “I like hot showers and cold beer.”

The buildout of the U.S. grid is concerning. Within a few years, at the rate we are at, our grid will be at maximum capacity. There needs to be a Manhattan Project-style undertaking, but instead, we are tariffing copper and canceling renewable energy projects. Copper is the primary material used as a conductor of electricity in building any kind of energy infrastructure. Without beating China in energy generation, the AI race is lost, and if you look at the graph above, we are already getting left in the dust. Only the future holds who will win in AI and essentially manufacturing for the world, but as of now, I’m just appreciating sleeping comfortably cold.

Investments