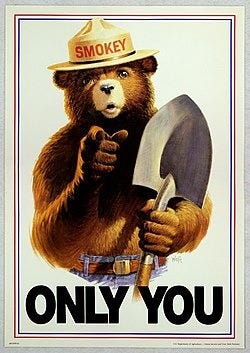

Smokey Bear

January 2026

The Rover

Smokey the Bear was a real bear.

I was shocked to hear that. All my life, I just thought he was a cartoon character, campaigning to protect the wilderness from wildfires.

Or something to remind humans not to be idiots while out in nature, as up to 95% of wildfires are started from human carelessness.

The famous slogan, “only you can prevent wildfires,” hits a little differently when you realize that fact.

The Smokey Bear campaign, launched in 1944, is America’s longest-running public service announcement (PSA) campaign, promoting wildfire prevention through the iconic bear. The real Smokey Bear was a live American black bear cub rescued from a New Mexico wildfire in 1950, who became the living symbol for wildfire prevention, residing at the National Zoo in Washington DC and receiving fan mail before being buried back in his home state. His story inspired the long-running "Only YOU can prevent wildfires" campaign, making him a national icon for forest fire prevention and conservation.

The United States has always cared about wildfires to some extent as westward expansion increased in the 1800s, but this concern grew dramatically with Americas involvement in WWII.

The reasons for the increased wildfire awareness:

Manpower shortages as experienced firefighters and able-bodied men were off fighting a war.

Japan launched thousands of incendiary balloons across the Pacific, with about 11% reaching the U.S., causing fires and fear on the West Coast.

Forest fires threatened crucial timber resources needed for the war effort, making fire prevention a matter of national security.

Concerns grew that enemy agents could exploit fires, and the shelling of a California oil field in 1942 heightened fears of attacks on U.S. soil

Six years after the Smokey Bear campaign launched, a fire raged outside Capitan, New Mexico.

In Capitan, NM, firefighters discovered a small, scared bear cub motherless near the fire line, badly burned and with blistered paws, after he'd climbed a tree for safety.

The crew wrapped the cub in their jackets, carried him to safety, and gave him to Ranger Ray Bell.

Ranger Bell flew the cub to Santa Fe for treatment by a veterinarian, who bandaged his burns.

News of the rescued cub spread, and the public named him "Smokey Bear," after the existing wildfire prevention character.

The New Mexico State Game Warden offered the cub to the Forest Service, who accepted him as a living symbol for their campaign.

Smokey was sent to the National Zoo in Washington, D.C., where he became a beloved attraction for 26 years, teaching millions about fire safety.

And the rest is history.

Smokey retired in 1975, and upon his death in 1976, his body was returned to Capitan, New Mexico, where he’s buried at the Smokey Bear Historical Park.

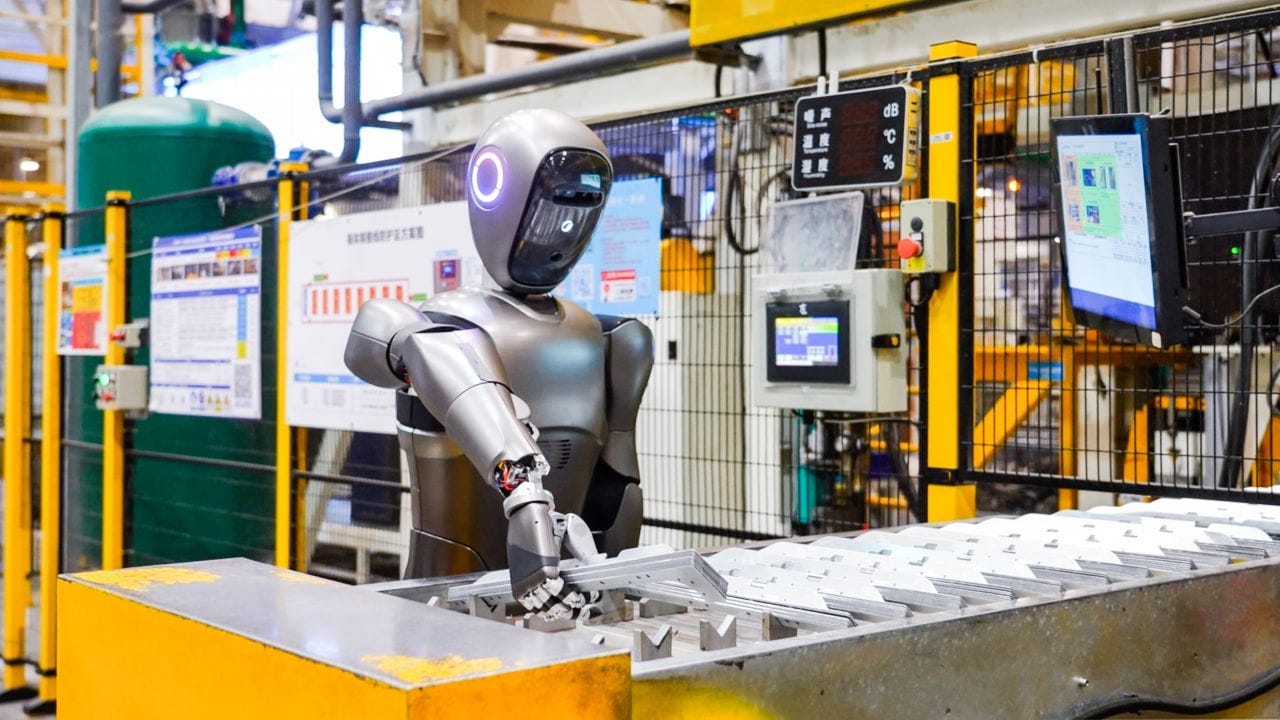

Robots and AI Are Already Remaking the Chinese Economy — Luke Gromen

Robots and AI Are Already Remaking the Chinese Economy —WSJ

For reasons I don’t understand, some actually believe AI is dumb. “Well, ChatGPT gave me a wrong answer when I asked it this…”

The fact that we are even debating this still in the US means we are falling behind against China, which is using AI to drive productivity gains at levels never seen before.

While China’s long-term AI goals are no less ambitious than the U.S. tech titans, its near-term priority is to shore up its role as the world’s factory floor for decades to come. With exports under threat from rising costs at home and tariffs abroad, that is no longer assured.

The push can be seen across the giant country in scores of companies—fueled by billions of dollars in government and private technology development—that are transforming every step of making and exporting goods.

A clothing designer reports slashing the time it takes to make a sample by more than 70% with AI. Washing machines in China’s hinterland are being churned out under the command of an AI “factory brain.”

At one of China’s biggest ports, shipping containers whiz about on self-driving trucks with virtually no workers in sight, while the port’s scheduling is run by AI.

Executives involved in China’s efforts liken the future of factories to living organisms that can increasingly think and act for themselves, moving beyond the preprogrammed tasks at traditionally-automated factories. It could further enable the spread of “dark factories,” with operations so automated that work happens around the clock with the lights dimmed.

China installed 295,000 industrial robots last year, nearly nine times as many as the U.S. and more than the rest of the world combined, according to the International Federation of Robotics. China’s stock of operational robots surpassed two million in 2024, the most of any country.

Nearly a decade ago, Midea made clear its ambitions to automate by acquiring control of German robotics specialist Kuka. Today, Kuka’s robots at Midea’s Jingzhou washing-machine factory work under what Midea calls an AI “factory brain,” which acts as a sort of central nervous system running much of what happens in the plant.

The computerized brain manages 14 virtual agents inside the factory that communicate with each other to figure out the best way to carry out tasks, with orders flowing down to robots and other machines on the factory floor. It’s a step toward Midea’s goal of using AI to more holistically automate processes at its factories.

“You feed in all the data, and let AI figure it out,” said Xi Wei, director of the Midea Humanoid Robot Innovation Center. With a Ph.D. from the University of Maryland, Xi spent years living in Silicon Valley before returning to China to develop advanced robots for Midea.

Where human workers are still required, some have been outfitted with AI-powered glasses that can flag common product errors based on inspection history. Processes that previously took 15 minutes now can be done in 30 seconds.

In a sign of how the company wants to use technology to drive efficiency, Midea reports that its revenue per employee grew by nearly 40% between 2015 and 2024.

A special priority for Xi has been upgrading the nation’s ports, a crucial step in reinforcing China’s dominance as the world’s manufacturing power.

The port of Tianjin, among China’s largest, has teamed up with Huawei to launch a fleet of unmanned trucks and a system dubbed OptVerse AI Solver, which optimizes tens of millions of variables and constraints such as ship arrival times and crane capacity to manage scheduling.

Planning that previously took 24 hours now takes 10 minutes, according to Huawei.

By last year, the port also launched PortGPT, an AI model developed with Huawei, whose ability to analyze video and images at the site could allow them to replace human safety officers going forward, a port executive told state media.

Similar stories are playing out around China, with half of the world’s top-20 ports in terms of vessel turnaround time located in the mainland, including Tianjin, according to the World Bank and S&P Global Market Intelligence.

Just one of 10 large U.S. container ports surveyed by the Government Accountability Office had deployed driverless vehicles as of mid-2023, while only five were using AI and machine learning.

In Tianjin, more than 88% of large container equipment is already automated, state media said this year. For visitors to the port, a video sums up China’s growing AI self-belief: “We are the future,” the narrator says.

The debate is over.

We are already at the inflection point: if we don’t do something like TODAY, we will never catch up to China in manufacturing again.

China hawks are great at pounding their chest about how the US stock market (up 428%) has crushed the China stock market (up 19%)

This chart from Luke Gromen tells a different story.

Since the trade war started, the China index has doubled the S&P.

The markets are slowly picking up what China is putting down.

China is gaining efficiencies while the US is still debating the topic.

The dollar is too strong to be competitive with China, and we need it to fall by as much as 80% for the US to be competitive.